Goldenity AI EA

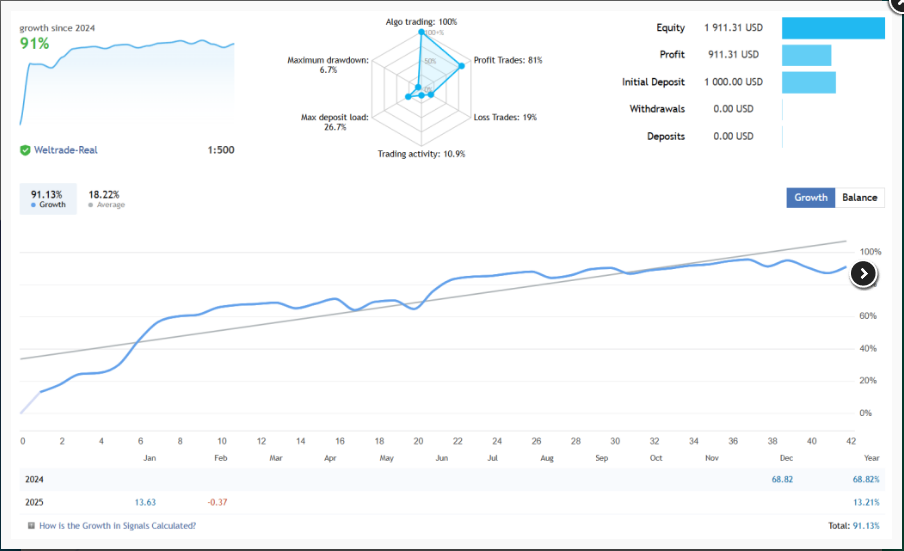

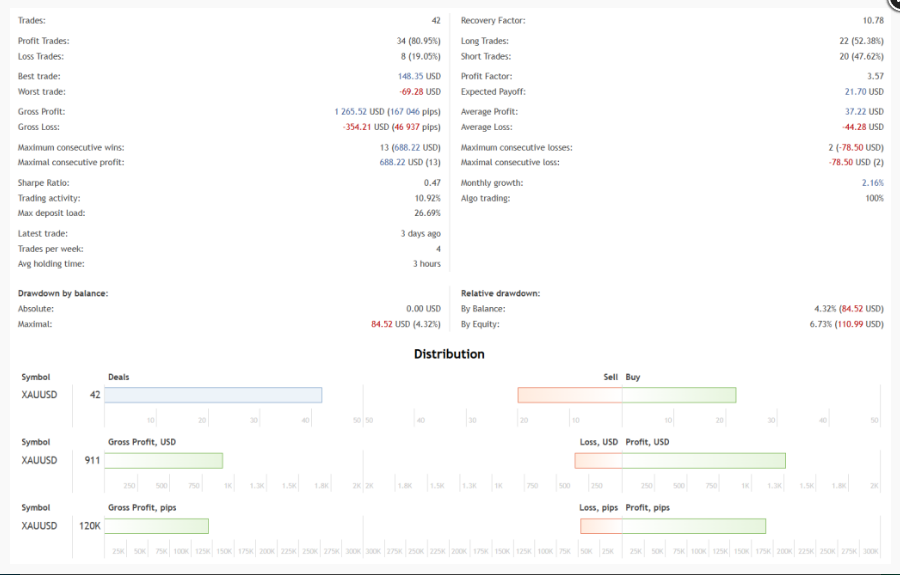

Goldenity AI EA presents itself as an innovative trading tool designed for those interested in the gold market. Drawing from a blend of price action trading and market analysis, this EA promises to harness the power of artificial intelligence specifically for trading gold.

Goldenity AI EA identifies key market structures, focusing primarily on the H1 timeframe. It pays close attention to swing highs and lows while simultaneously analyzing micro-movements on an M15 scale and broader trend patterns on an H4 timeframe.

The EA claims to utilize neural networks capable of recognizing high-probability setups in the gold market. These setups reportedly include Asian session breakouts, European open volatility patterns, and New York session trend continuations. The strategy boasts an understanding of gold’s unique traits—its tendency to establish clear support and resistance levels, its response to technical patterns, and its distinct behavior during different market sessions.

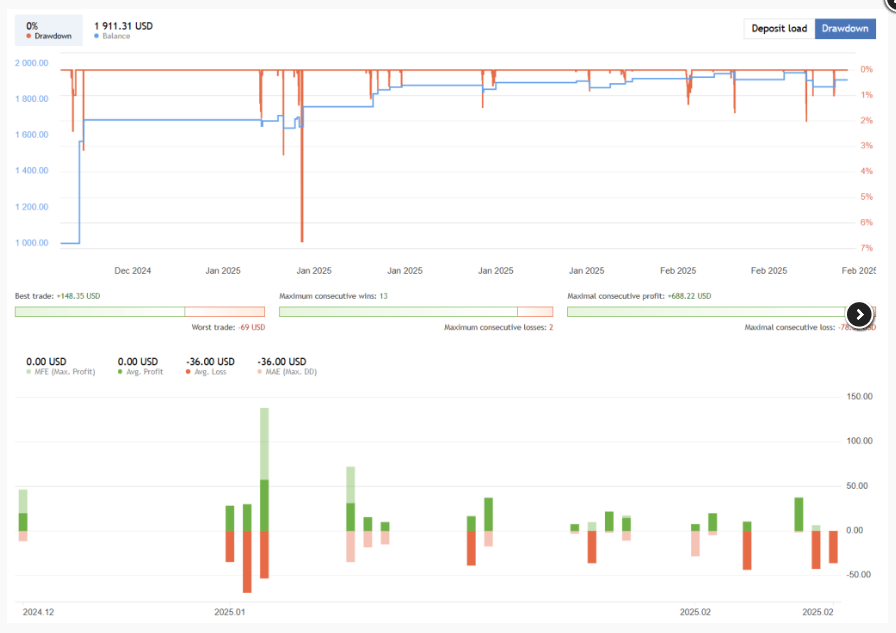

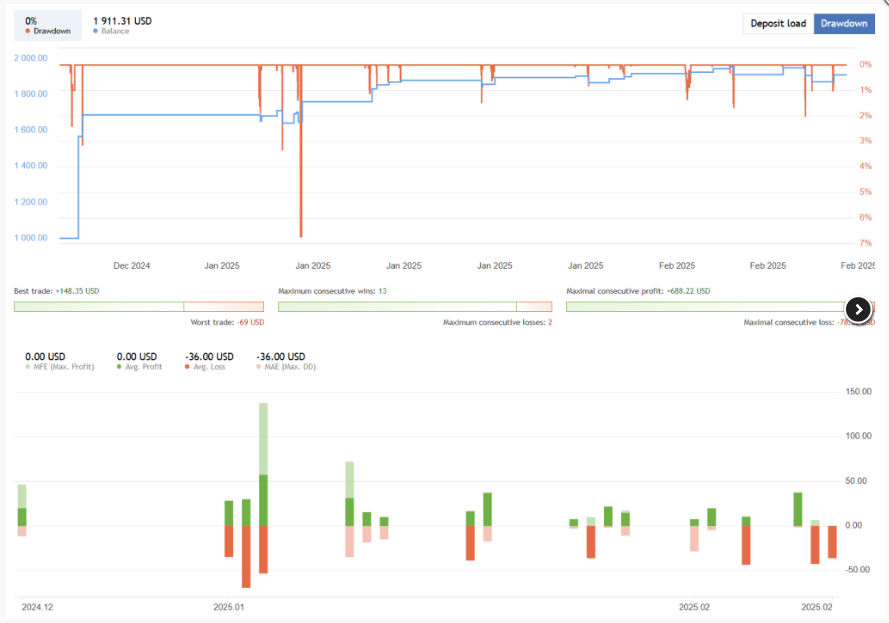

The EA is designed to manage trades once open, adjusting take-profit and stop-loss levels based on ongoing market conditions like real-time volatility and price action developments. This facet aims to allow Goldenity to capitalize on both trending movements and range-bound opportunities potentially. Nonetheless, whether such dynamic adjustments can consistently yield favorable outcomes without exposing traders to undue risk is a key question for potential users.

Unpacking AI and Neural Network Claims

Goldenity purports to employ cutting-edge AI and neural networks trained on years of historical gold price data. While this technology sounds impressive, it is important to remain skeptical about such claims, as they can often be difficult to verify. The effectiveness of AI in identifying complex market structures or significant moves remains largely speculative unless proven through rigorous testing and transparency.

AI-driven mechanisms are said to evaluate multiple factors before executing a trade. These include the H1 price action structure, trend alignment across M15 and H4, volume profile and market depth, recent volatility patterns, historical success rate, and the current market phase. Only when these elements align does the EA purportedly make a trade decision.