Invisible Power Indicator - Comprehensive Guide🏆 Motto:"Unlock the hidden strength of the markets - trade with the power of precision!"

📌 OverviewThe Invisible Power indicator is a sophisticated Stochastic-based trading system that identifies potential reversal points in the market. It combines multiple confirmation methods including Stochastic crossovers and overbought/oversold conditions to generate high-probability trading signals.

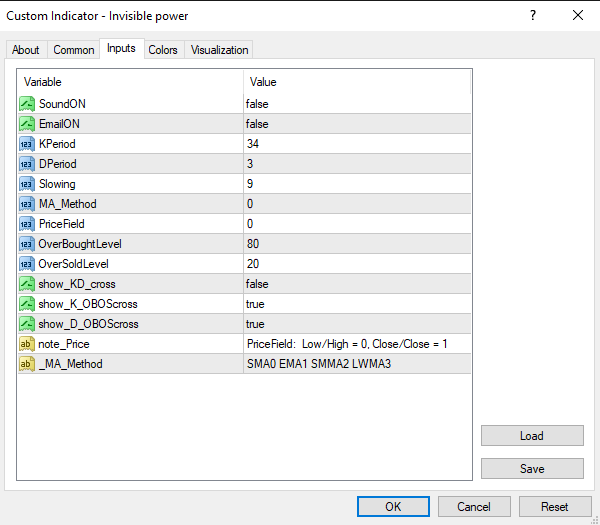

🔧 Indicator SettingsCore Parameters:KPeriod (Default: 34) - Main period for %K line calculation

DPeriod (Default: 3) - Period for %D signal line

Slowing (Default: 9) - Smoothing factor for Stochastic

MA_Method (Default: 0) - Moving average method:

0 = SMA (Simple)

1 = EMA (Exponential)

2 = SMMA (Smoothed)

3 = LWMA (Linear Weighted)

PriceField (Default: 0) - Price calculation basis:

0 = Low/High

1 = Close/Close

Signal Parameters:OverBoughtLevel (Default: 80) - Upper threshold for overbought condition

OverSoldLevel (Default: 20) - Lower threshold for oversold condition

show_KD_cross - Enable/disable basic Stochastic crossover signals

show_K_OBOScross - Enable/disable %K line overbought/oversold crossings

show_D_OBOScross - Enable/disable %D line overbought/oversold crossings

Alert Options:SoundON - Enable audio alerts

EmailON - Enable email notifications

📊 How It WorksSignal Generation Logic:Stochastic Calculation:

Computes traditional %K and %D lines based on user-defined periods

Applies selected smoothing method (SMA/EMA/SMMA/LWMA)

Three Signal Types:

Basic Crossover: %K crossing %D (when show_KD_cross enabled)

%K Boundary Cross: %K crossing overbought/oversold levels (when show_K_OBOScross enabled)

%D Boundary Cross: %D crossing overbought/oversold levels (when show_D_OBOScross enabled)

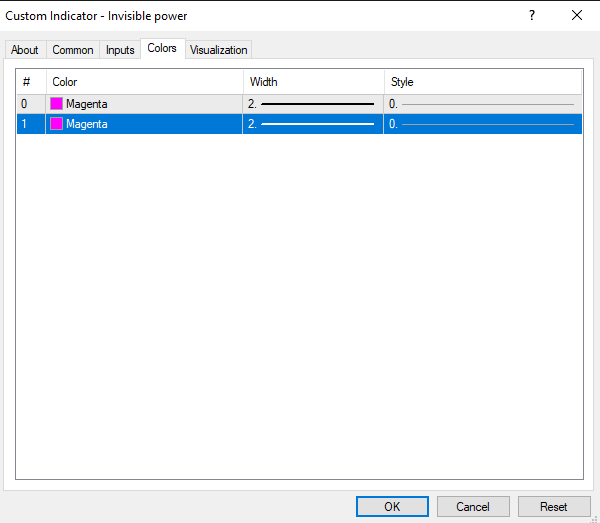

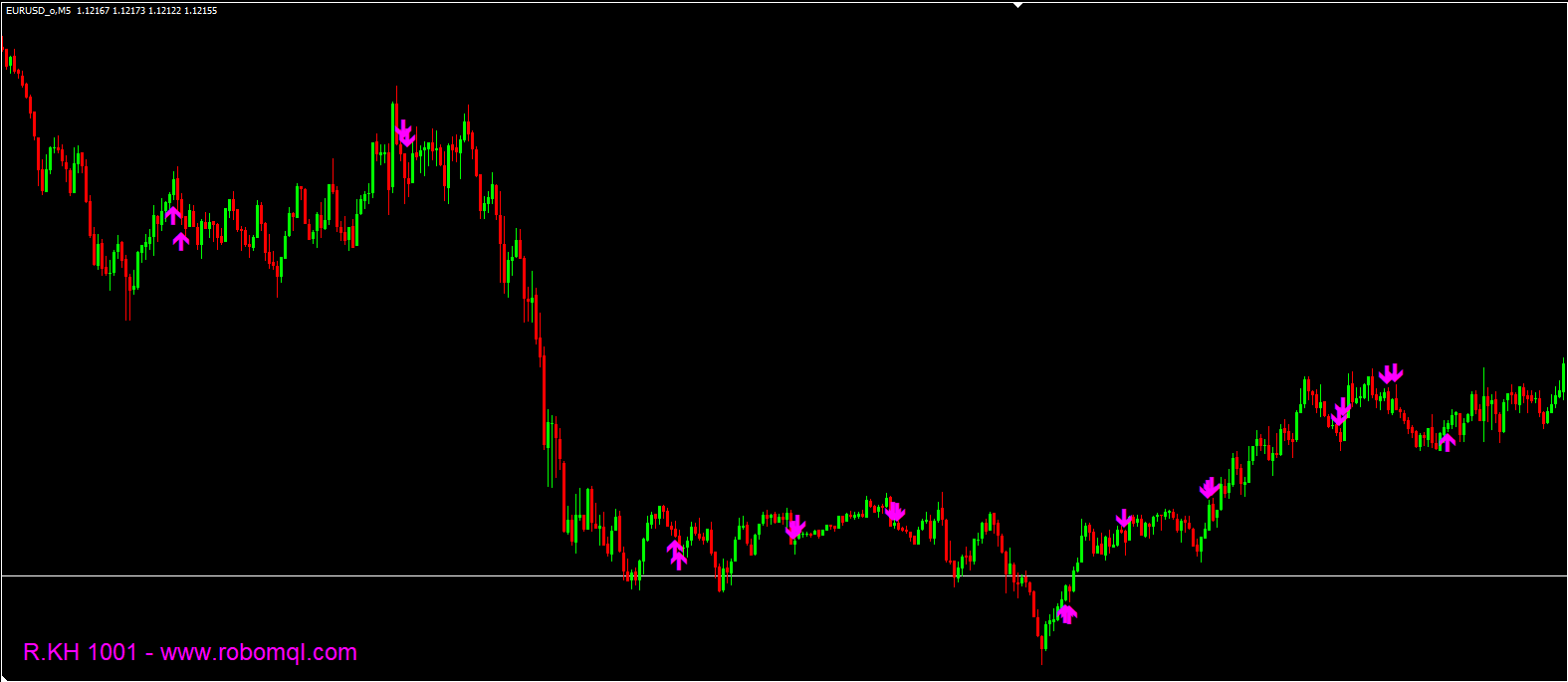

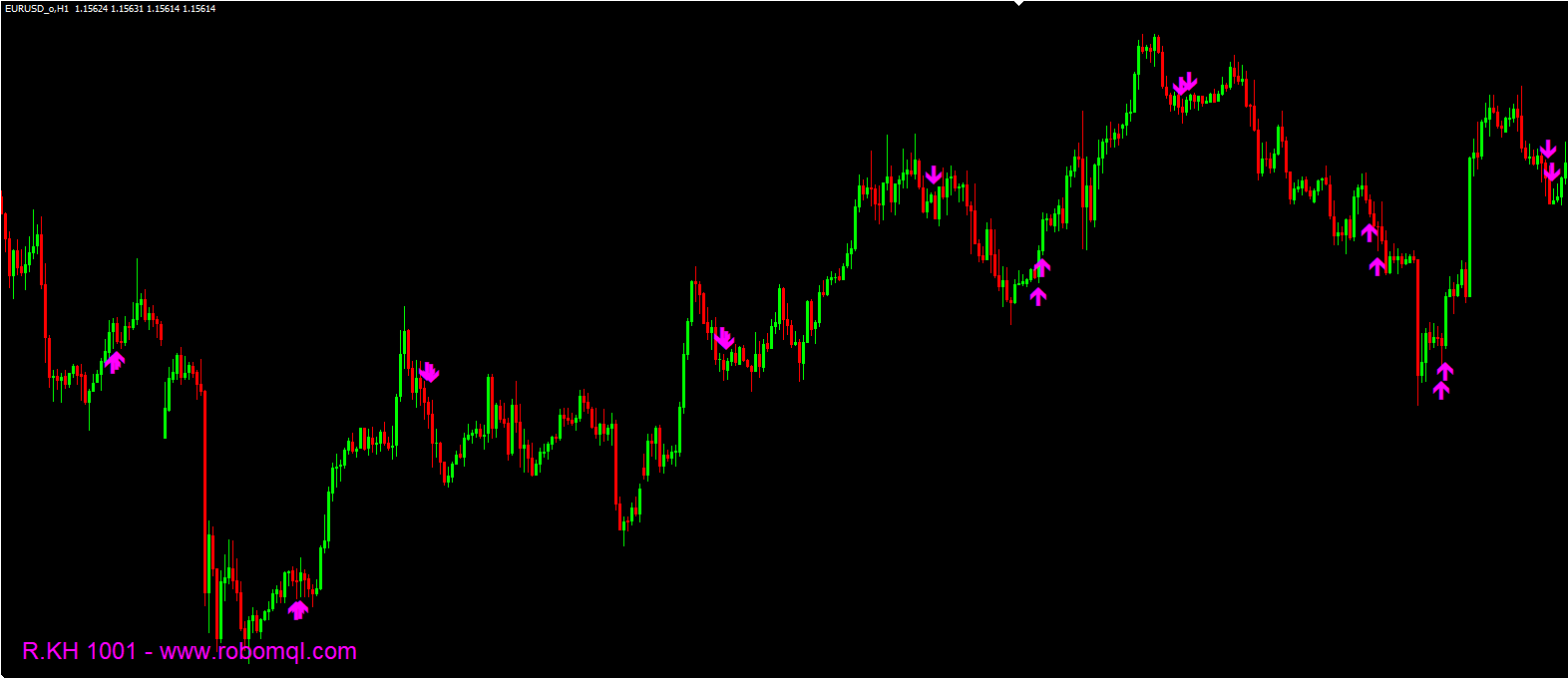

Visual Presentation:

Fuchsia Up Arrows: Buy signals appear below price

Fuchsia Down Arrows: Sell signals appear above price

Arrow placement adjusts dynamically based on recent volatility

Alert System:

Generates real-time alerts via sound/email when new signals appear

Includes detailed price and timing information in notifications

🎯 Trading Strategy SuggestionsOptimal Usage:Best suited for swing trading on H1-D1 timeframes

Works exceptionally well in ranging markets

Can be used as confirmation in trending markets when combined with other indicators

Entry Points:Long Positions: When all enabled signal conditions agree on bullish reversal

Short Positions: When all enabled signal conditions agree on bearish reversal

Risk Management:Use recent Average Range (displayed with signals) for stop-loss placement

Consider taking partial profits at opposite signal or key support/resistance levels

🔍 Additional FeaturesSmart Signal Filtering: Avoids repainting by using confirmed closes

Dynamic Positioning: Arrows adjust based on market volatility

Multi-Timeframe Capable: Can be applied across different chart periods

📜 Developer & SourceDeveloper: R.KH 1001

Source: RoboMQL

🚀 Harness the invisible forces of the market - trade with confidence and precision! 🚀