Mean Reversion Trading EA FREE Download [Update]

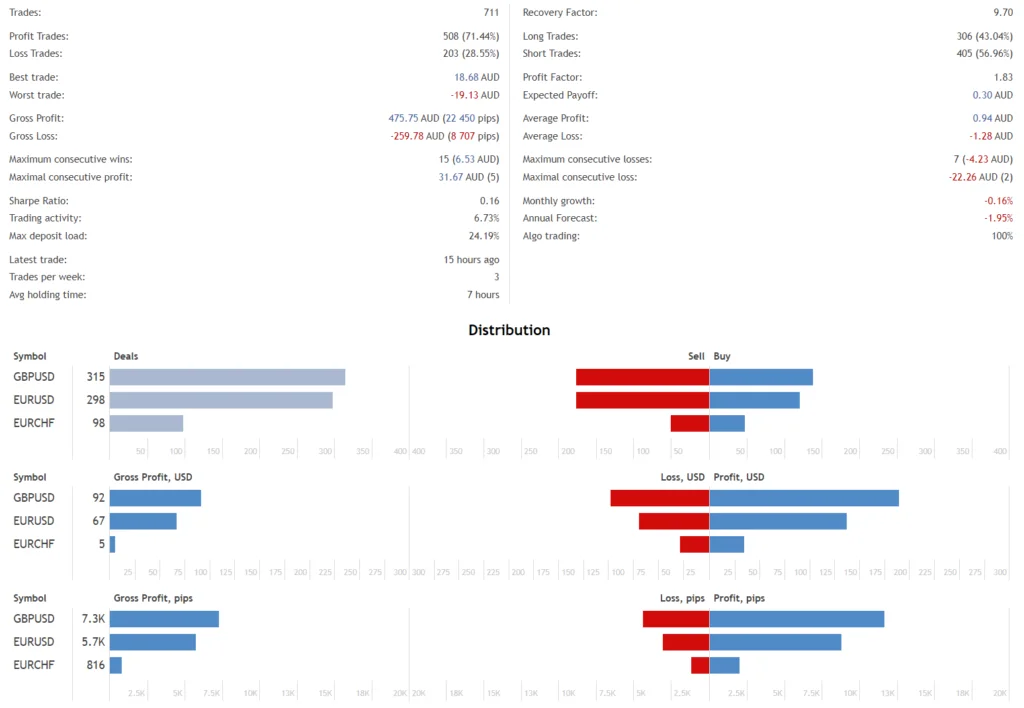

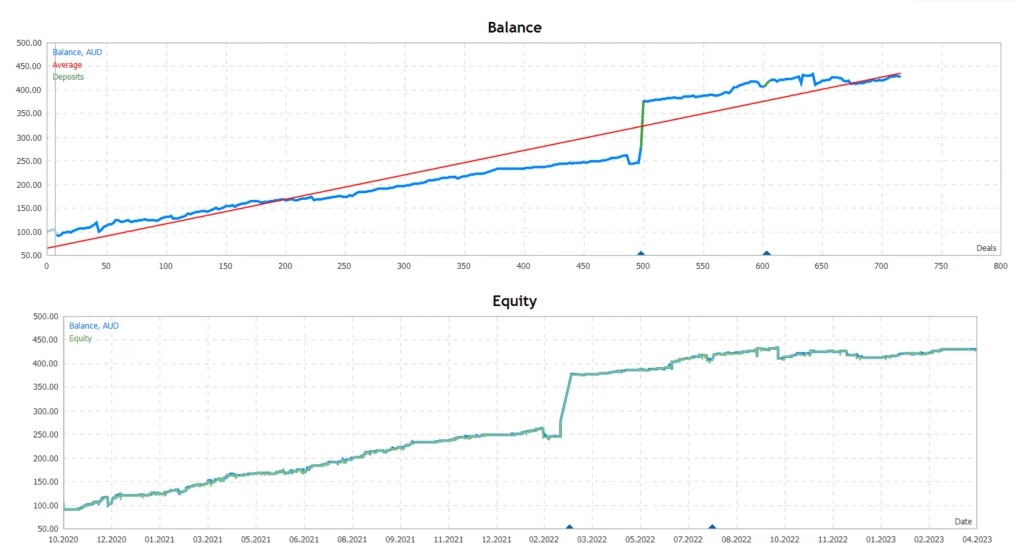

Reversion Trading EA is a mean-reversion trading system crafted for the fast-paced environment of the American trading session. Unlike many scalping systems available in the market, the Mean Reversion Trading EA is explicitly tailored for cross pairs known for their strong mean-reverting tendencies. This ensures high-profit targets, optimizing the balance between risk and reward.

Its operational hours are from 19:00 to 23:00, abstaining from trades during the rollover periods of 0:00-1:00. As for trade durations, it falls within the typical scalping category, with trades lasting a few hours at most.

This EA employs algorithms to determine entry and exit points in the market. Unlike some systems, it does not incorporate martingale or grid tactics. Each trade is executed via market orders, with a predefined stop loss, safeguarding investments against unforeseen market volatilities.

Mean Reversion in Forex Trading

Mean reversion is a financial theory suggesting that asset prices and historical returns eventually revert back to the entire dataset’s long-run mean or average level. In simpler terms, if a stock or currency pair’s price escalates significantly, it will eventually come down, and vice versa. This concept stems from the belief that in the short term, markets might overreact to news, events, or sentiment, but they will return to their intrinsic value over the long term.

In the context of forex trading, the theory translates into the belief that major currency pairs are likely to move around certain equilibrium levels or averages over time. When a pair deviates too far from its average, it’s expected to revert back, offering traders potential profit opportunities.

Features of Mean Reversion Robot

The following are the notable features of the Mean Reversion Robot:

Single Chart Setup: The system allows trading multi-currency from a singular chart setup.

Trading Times: It refrains from initiating trades during periods of potentially low liquidity, notably the bank rollover timings of 0:00-1:00.

Filters and Detection Mechanisms:

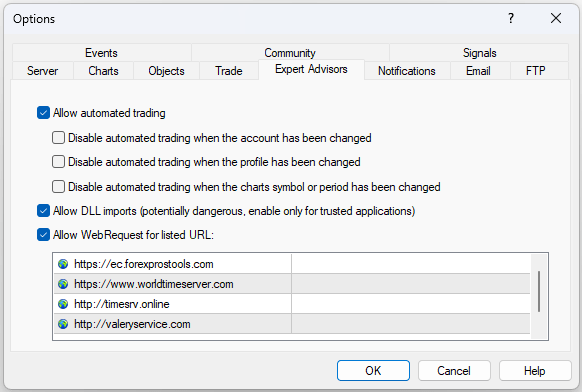

Advanced News Filter: This is designed to keep track of market news.

Stock Market Crash Filter: Intended to recognize significant market downturns.

Auto GMT Detection: Automates the adjustment based on the trader’s time zone.

Negative Swap Filter: Aims to avoid trades with potential negative interest charges.

Please test in a demo account first for at least a week. Also, please familiarize yourself and understand how this Mean Reversion Robot works, then only use it in a real account.